Table Of Content

To help you compare the best home insurance quotes from Policygenius, our team of home insurance experts gave each of the largest home insurance companies in the U.S. by market share a Policygenius rating. Progressive Home® policies are placed through Progressive Advantage Agency, Inc. with insurers affiliated with Progressive and with unaffiliated insurers. Each insurer is solely responsible for the claims on its policies and pays PAA for policies sold.

Bundle auto and homeowners insurance

A good time to compare home insurance quotes is when you review your policy before your annual renewal. You’ll want to make sure your current policy fits your coverage needs. For example, you can create a home inventory to ensure your personal belongings are adequately covered. Or you can look into increased dwelling coverage (such as guaranteed replacement cost). We're the only homeowners insurance company that lets you compare home insurance quotes and coverages from multiple providers.

Nationally, more than half of U.S. homes are underinsured.1

Among the home insurance companies we analyzed, average rates show a cost increase of 32% from $350,000 to $500,000 in dwelling coverage and a 41% cost increase going from $500,000 to $750,000 in coverage. The information provided on this site has been developed by Policygenius for general informational and educational purposes. We do our best to ensure that this information is up-to-date and accurate. Any insurance policy premium quotes or ranges displayed are non-binding. The final insurance policy premium for any policy is determined by the underwriting insurance company following application. Along with coverage limits, your home's location has a major impact on your home insurance rates.

Common questions about homeowners insurance

Whether you’re working with an agent or on your own, plan to get at least three quotes. When comparing quotes, check that each policy has similar deductibles and coverage limits. You can get homeowners insurance quotes online, by calling the company or through a “captive” or independent agent. Here are the advantages and disadvantages of some of these methods. A standard home insurance policy covers personal belongings on an actual cash value (ACV) basis by default. This means if, say, your couch is damaged or destroyed and you file a claim, you'll only be reimbursed for the depreciated value of the property at the time of the loss.

Bankrate’s insurance editorial team, which includes licensed insurance agents and industry professionals, can help you understand how to find proper insurance coverage in the Golden State. We assessed the average rates, coverage options, discounts, third-party scores and ratings, and digital tools of California home insurance companies to find the options that stand out. We think homeowners will appreciate Chubb’s excellent customer service and extended replacement cost coverage. Owners of high-value homes will appreciate Chubb’s high liability coverage limits. The company also offers the option to receive a cash settlement if your house is destroyed and you don’t wish to rebuild. Top-notch service includes Chubb’s Wildfire Defense Service for clients in wildfire-prone areas.

7 Best Homeowners Insurance Companies in Virginia of 2024 - MarketWatch

7 Best Homeowners Insurance Companies in Virginia of 2024.

Posted: Tue, 23 Apr 2024 07:00:00 GMT [source]

To cover costs related to flooding, homeowners can purchase flood insurance from the National Flood Insurance Program or a private insurer. If your home was damaged, you should try to prevent more damage, such as boarding up a broken window. We wouldn’t suggest fixing the problem before contacting your insurance company.

We found that USAA delivers low prices and quality service to military members, veterans and their families. Those who are eligible should definitely consider USAA insurance. We also like that customers can take advantage of a variety of discounts through the USAA perks program, including hotels, rental cars and cruises. NerdWallet calculated median rates for 40-year-old homeowners from various insurance companies in every ZIP code across the U.S. The NAIC website is another source of information about how insurance companies have performed. You can find out how many complaints were filed against an insurer with state regulators, the reasons for the complaints, and whether there were more complaints than expected for a company of its size.

Policy Service and Claims

Regardless of how you go about calculating your dwelling coverage limit, you should make sure it's high enough to cover the home's replacement value, which is the price to rebuild it at today's prices. On average, home insurance premiums differ substantially based on how much dwelling coverage is in your policy. Here’s the average annual home insurance rate for five different levels of dwelling coverage.

In California, policyholders with one recent claim pay an average of $1,390 per year — an increase of 11%. Our sample homeowner had good credit, $300,000 of dwelling coverage, $300,000 of liability coverage and a $1,000 deductible. Insurance companies offer many home insurance discounts that can reduce your policy costs. We found that State Farm has decent prices and the highest average discount for bundling home and auto insurance among the companies we evaluated. Dog owners will like that the company doesn’t have a banned dog list.

If you have a mortgage, make sure to let your lender know about the change. Like independent agents, independent brokers also work on commission. But unlike independent agents, independent brokers may also charge a broker’s fee, which they generally must disclose to customers. This transparency allows you to know exactly how much the broker is earning from your business.

If you wouldn’t have enough money put aside to cover a high deductible, it’s best to choose a lower one. The average home insurance premium in the U.S. is $1,754 per year, according to a 2023 Policygenius analysis of home insurance premiums in every U.S. state and ZIP code. Because insurance companies often calculate ACV based on an item's lifespan rather than its physical condition, ACV payouts tend to be far less compared to RCV.

To help you determine how much home insurance is right for you, it is first helpful to understand what a typical home insurance policy includes — and excludes — so you can structure a policy that works for you. Pat Howard is a managing editor and licensed home insurance expert at Policygenius, where he specializes in homeowners insurance. His work and expertise has been featured in MarketWatch, Real Simple, Fox Business, VentureBeat, This Old House, Investopedia, Fatherly, Lifehacker, Better Homes & Garden, Property Casualty 360, and elsewhere. Allstate is one of the most popular home insurance providers in the country thanks to several customizable options, unique coverage add-ons like short-term rental coverage, and availability in all 50 states. In addition to deciding how much of each coverage you need, you should also look at how claim settlements are determined when comparing policies from different companies. We offer insurance by phone, online and through independent agents.

When getting a home insurance quote, the price you receive is the result of multiple coverage limits and policy details. That means you should consider more than the final price on the quote. One company may have higher monthly premiums, but you may also get more coverage for the price. The details below can help you get a sense of what to expect when comparing homeowners insurance rates.

For Policy A, you'll receive actual cash value after a loss, meaning you'll have to pay some amount out of pocket to completely replace the item. The replacement cost with Policy B, on the other hand, means your insurance company will reimburse you the full cost to replace your belongings after a loss. When comparing quotes from different insurance companies, you’ll have multiple components to compare. As an example, we made up two sample policies, which are described in part below. A standard home insurance policy excludes several types of problems. For example, common exclusions for house damage found in an HO-3 include floods, earthquakes, sinkholes, war, power failure, nuclear hazard, wear and tear, intentional loss, and vermin and insect infestations.

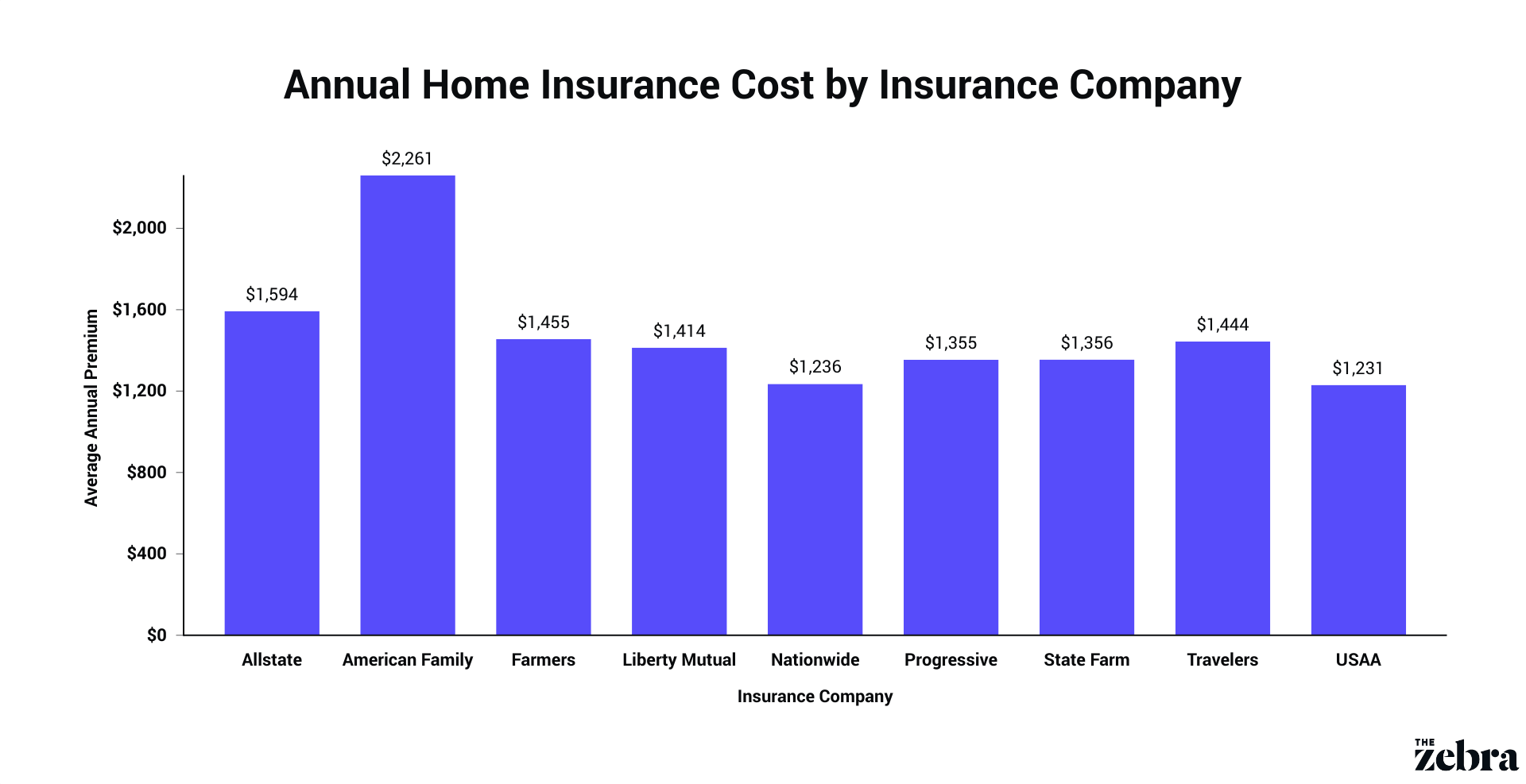

The price for similar coverage can vary drastically among insurers, as you’ll see below. When comparing rates in your best home insurance quotes, keep in mind that the average annual cost of home insurance is $1,754 for a policy with $300,000 in dwelling coverage. Comparing home insurance quotes from multiple insurers is the best way to find the right coverage for your needs at the cheapest price.

No comments:

Post a Comment