Table Of Content

I don’t think I would still be with Progressive if it weren’t for my agent, Kim Milligan. When you click "Continue" you will be taken to a site owned by , not GEICO. Any information that you provide directly to them is subject to the privacy policy posted on their website.

Home insurance company reviews

Beyond those, you may see differences in both the number and type of home insurance discounts available. Matching the discounts your home is eligible to receive will ensure that you get the policy you want and that you benefit from investments you've made in your home. Is your region prone to hurricanes, wildfires, earthquakes or other disasters? If so, you might want to spend a little extra time researching your coverage options. State Farm offers other freebies that can help keep your home safe. In most states, you can get a smart device called Ting that plugs into an outlet and monitors your home’s electrical system.

Does home insurance cover flooding?

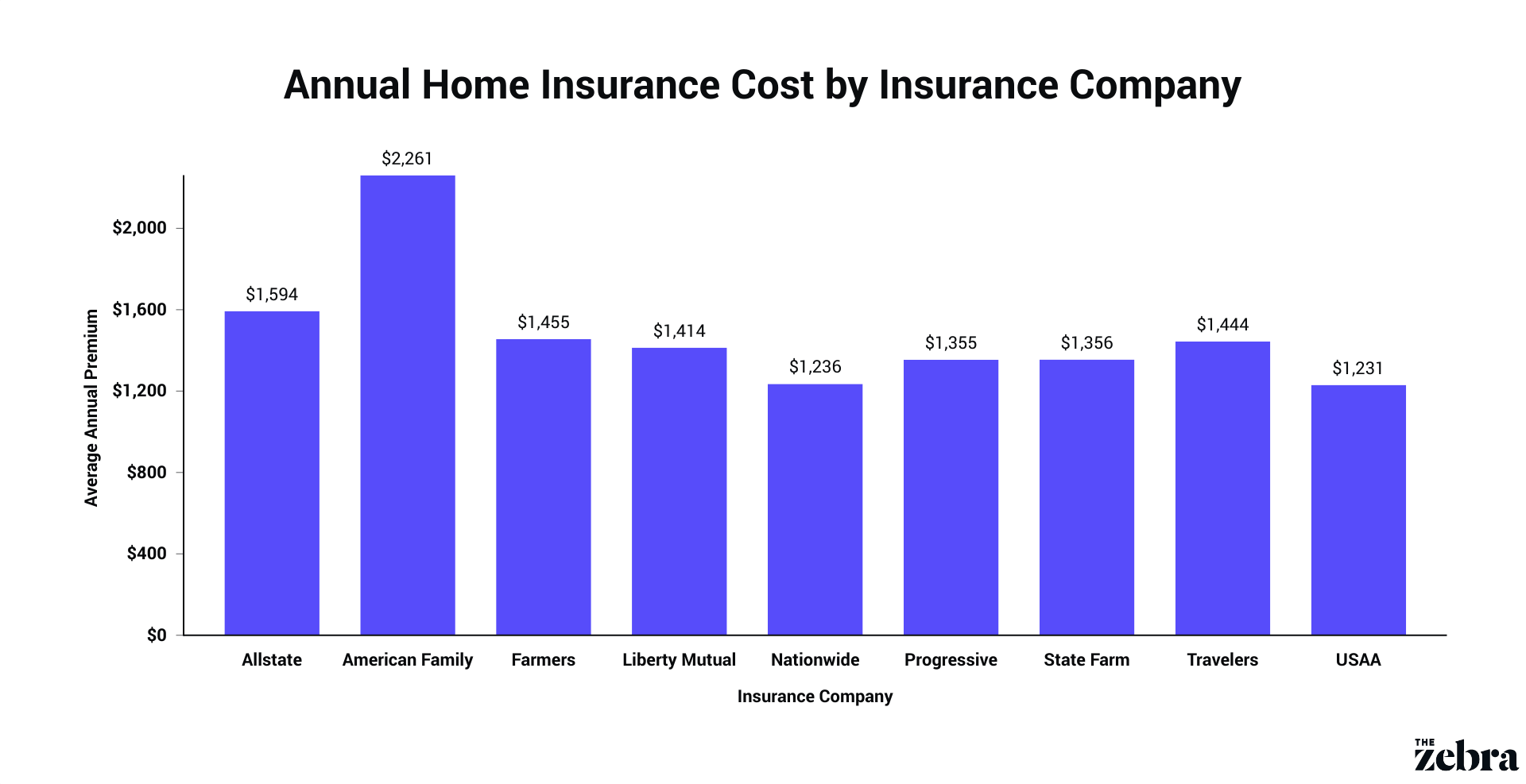

If you don’t, you could be missing out on savings for similar coverage with another insurance company. However, Travelers offers fewer discounts than most companies of its size, and its scores in J.D. Power’s 2022 customer satisfaction, claims, and digital experience surveys indicate that Travelers’ customer service could use some improvement. With an average premium of $1,966 per year, Nationwide home insurance is a hair more expensive than the national average. If you live in an area prone to flooding, a flood insurance policy may help protect against damage to your home and personal belongings. If you rent out a house to tenants or if your rental property is unoccupied, you'll need a dwelling policy rather than a homeowners policy to cover your rental home.

Full list of best homeowners insurance in California

4 Best Homeowners Insurance Companies in Orlando (2024) - MarketWatch

4 Best Homeowners Insurance Companies in Orlando ( .

Posted: Mon, 22 Apr 2024 07:00:00 GMT [source]

He is responsible for several industry-leading data solutions, including LexisNexis® Rooftop and LexisNexis® Current Carrier Property®. George has been with LexisNexis for more than 20 years, working in a variety of operational and strategic roles in both the LexisNexis Legal & Professional and LexisNexis Risk Solutions divisions. Review each basic coverage type and adjust the limits to fit your specific needs. Chubb offers home insurance policies in all 50 states and Washington, D.C.

However, USAA has strict eligibility requirements and is only available to military members, veterans and their eligible family members. Insurers use a number of personal rating factors to calculate home insurance premiums, such as your claims history, where you live, the age of your home and the amount of coverage you need. Every property insurer has its own rating system, so it’s helpful to compare homeowners insurance rates from several providers to find the best price.

His expertise on home and auto insurance has been featured on Forbes, Consumer Affairs, Realtor.com, Apartment Therapy, SFGATE, Bankrate, and Lifehacker. Nationwide home insurance features a slew of comprehensive coverage options. Power, indicating you can rely on Nationwide when it matters most. Comparing all of these different coverage types and limits can help you determine which quote makes the most sense for your needs and budget. Looking at the two fictional quotes above, you can see that while State Farm has higher premiums than Allstate, you only have to pay $500 when you file a standard claim — versus $2,000 with Allstate. Here's an example of two quotes you might get for home insurance coverage and how to compare them.

The part of your policy that pays if you accidentally hurt someone else or damage their property. The part of your policy that covers damage to your home's structure. Common liability claims include slip and fall injuries, dog bites, pool-related injuries, and trampoline-related accidents. Between medical bills, attorney fees, and legal settlements, a lawsuit could run you hundreds of thousands of dollars — potentially putting all of your assets at risk.

Best Homeowners Insurance in Michigan of April 2024 - MarketWatch

Best Homeowners Insurance in Michigan of April 2024.

Posted: Tue, 23 Apr 2024 07:00:00 GMT [source]

Some of these companies offer average rates lower than $1,200 a year or $100 a month. That's why even if you are happy with your current home insurance company, shopping around can't hurt. Let’s say you have $300,000 dwelling coverage with 50% personal property coverage.

California homeowners can also sign up for free Wildfire Defense Services. These services include personalized recommendations for protecting your home and deployment of firefighters to your house if a wildfire is approaching. George Hosfield is senior director and general manager of home insurance solutions at LexisNexis Risk Solutions. In this role, he manages all aspects of the personal lines property business, including overall strategy, profitable growth, new product development and partnerships.

The final cost of your homeowners insurance policy doesn't matter if you aren't receiving the coverage you need. Even if one company has lower monthly premiums, what if it doesn't fully cover you after a loss? That's why we recommend comparing price and the quote coverage limits. The national average cost of homeowners insurance is $1,582 per year, according to our analysis. That home insurance estimate is for a policy with $350,000 in dwelling coverage, $175,000 for personal property coverage and $100,000 in liability coverage.

These ratings are a guide, but we encourage you to shop around and compare several insurance quotes to find the best rate for you. California residents have multiple insurers to choose from, several of which offer more affordable premiums for homeowners insurance than the state average. To help you find the best home insurance company for you, we calculated a Bankrate Score to analyze each company across several categories. The rating sections include average annual premiums from Quadrant Information Services, available coverage, discounts and policy features. Power customer satisfaction ratings to indicate how satisfied customers are with their company’s service and AM Best ratings to assess financial stability. The higher a company ranked in each category, the higher its overall Bankrate Score — 5.0 being the highest possible.

Here are some of the factors that can affect your homeowners insurance quote. Because a home insurance quote is only an estimate, it may not precisely match the price you end up paying for coverage. In some cases, an inspector may come to your home and decide that you need a different amount of coverage, which can change the price. Depending on where you live, your insurance company may charge a separate deductible for certain types of claims such as those from hurricanes or windstorms. One quick, if not imperfect, way to estimate your home insurance coverage is by multiplying the square footage of your home by the average building cost per-square-foot in your area. To find out the cost to rebuild in your area, contact a few contractors in your area, get a quote, and then take the average of each one.